VAT Exempt Sales

If you are ordering from Tradingdepot.co.uk from either the Channel Islands (Jersey, Guernsey, Alderney, Sark, Herm), or a country outside of the European Union, you are exempt from paying UK VAT.

EU countries

As the Channel Islands are not members of the UK or EU for VAT purposes, any goods we export there are zero rated.

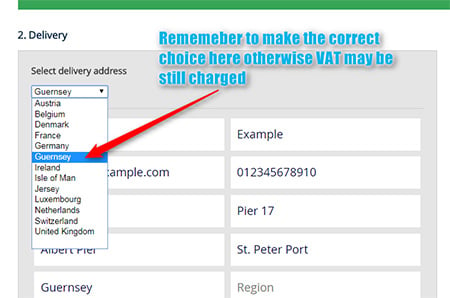

PLEASE ENSURE YOU SELECT GUERNSEY or JERSEY AT THE CHECKOUT (pictured)..

IF YOU SELECT UK THE WEBSITE WILL CHARGE VAT.

Note: Jersey customers may be liable for GST (Goods and Services Tax), rated at 5% locally.

Non-EU countries

VAT is not charged on products shipped to countries outside of the European Union, although local taxes may apply.

VAT Exemption for Disabilities

If you’re disabled or have a long-term illness, you won’t be charged VAT on products designed or adapted for your own personal or domestic use.

How to get the product VAT free

To get the product VAT free your disability has to qualify. For VAT purposes, you’re disabled or have a long-term illness if:

- you have a physical or mental impairment that affects your ability to carry out everyday activities, for example blindness

- you have a condition that’s treated as chronic sickness, like diabetes

- you’re terminally ill

- You don’t qualify if you’re elderly but able-bodied, or if you’re temporarily disabled.

You’ll need to confirm in writing that you meet these conditions. Your supplier may give you a form for this.

What Do I Do Next?

Read the Government guidance to see if you qualify

View The Official Government Guidance (Opens New Tab)Download our form, fill it in and email or post it back to us. Once we have received your form we will be in touch to process your order andtake payment.

Download our VAT Exemption Form (Opens New Tab)